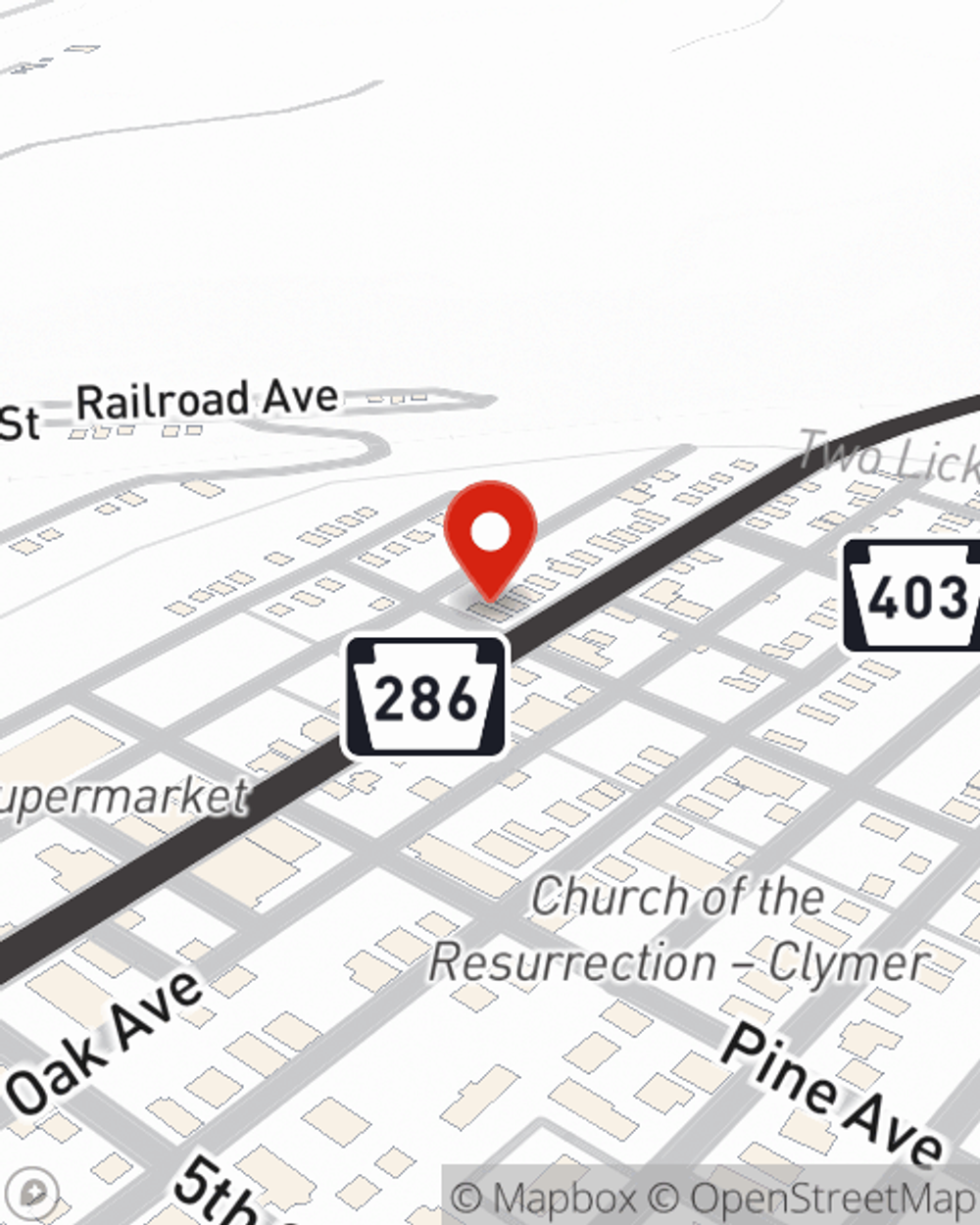

Life Insurance in and around Clymer

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

When facing the loss of a family member or a loved one, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and face life without the one you love.

Get insured for what matters to you

Life happens. Don't wait.

Love Well With Life Insurance

Having the right life insurance coverage can help loss be a bit less overwhelming for your loved ones and allow time to grieve. It can also help cover certain expenses like medical expenses, future savings and utility bills.

Don’t let fears about your future stress you out. Call or email State Farm Agent David Smith today and explore the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call David at (724) 254-1645 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

David Smith

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.